Does Umbrella Insurance Cover Deductible . umbrella insurance (also known as excess liability insurance) is a type of coverage designed to cover potential gaps left by other insurance. an umbrella policy protects you from lawsuits and large claims that your homeowners or auto insurance policies don’t cover. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. how does umbrella insurance work? umbrella insurance is a type of personal liability insurance that can be indispensable when you find yourself liable for a claim larger than. Umbrella insurance kicks in when you reach your “base” liability limits for a. does umbrella insurance qualify as a tax deduction?

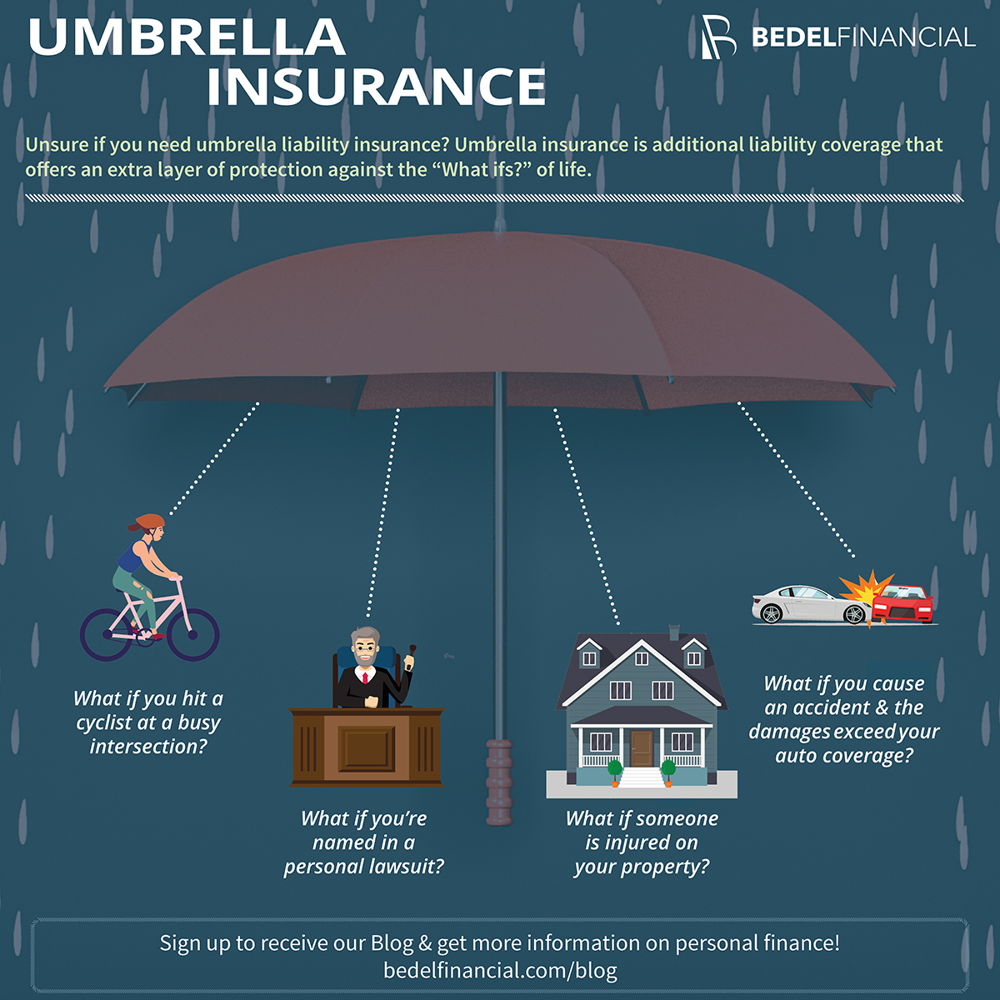

from www.bedelfinancial.com

umbrella insurance is a type of personal liability insurance that can be indispensable when you find yourself liable for a claim larger than. how does umbrella insurance work? umbrella insurance (also known as excess liability insurance) is a type of coverage designed to cover potential gaps left by other insurance. does umbrella insurance qualify as a tax deduction? an umbrella policy protects you from lawsuits and large claims that your homeowners or auto insurance policies don’t cover. Umbrella insurance kicks in when you reach your “base” liability limits for a. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets.

Umbrella Liability Insurance

Does Umbrella Insurance Cover Deductible umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. does umbrella insurance qualify as a tax deduction? umbrella insurance is a type of personal liability insurance that can be indispensable when you find yourself liable for a claim larger than. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. how does umbrella insurance work? umbrella insurance (also known as excess liability insurance) is a type of coverage designed to cover potential gaps left by other insurance. an umbrella policy protects you from lawsuits and large claims that your homeowners or auto insurance policies don’t cover. Umbrella insurance kicks in when you reach your “base” liability limits for a.

From www.vergeinsurance.com

Understanding Umbrella Insurance Verge Insurance Does Umbrella Insurance Cover Deductible umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. Umbrella insurance kicks in when you reach your “base” liability limits for a. an umbrella policy protects you from lawsuits and large claims that your homeowners or auto insurance policies don’t cover. umbrella insurance (also known as excess liability. Does Umbrella Insurance Cover Deductible.

From allianceoftherockies.com

What Do Umbrella Insurance Policies Cover? Does Umbrella Insurance Cover Deductible umbrella insurance is a type of personal liability insurance that can be indispensable when you find yourself liable for a claim larger than. an umbrella policy protects you from lawsuits and large claims that your homeowners or auto insurance policies don’t cover. how does umbrella insurance work? does umbrella insurance qualify as a tax deduction? . Does Umbrella Insurance Cover Deductible.

From www.tffn.net

How Much Does Umbrella Insurance Cost? A Comprehensive Guide The Enlightened Mindset Does Umbrella Insurance Cover Deductible how does umbrella insurance work? Umbrella insurance kicks in when you reach your “base” liability limits for a. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. an umbrella policy protects you from lawsuits and large claims that your homeowners or auto insurance policies don’t cover. umbrella. Does Umbrella Insurance Cover Deductible.

From www.bedelfinancial.com

Umbrella Liability Insurance Does Umbrella Insurance Cover Deductible how does umbrella insurance work? does umbrella insurance qualify as a tax deduction? umbrella insurance is a type of personal liability insurance that can be indispensable when you find yourself liable for a claim larger than. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. an. Does Umbrella Insurance Cover Deductible.

From www.hillsia.com

Have you considered umbrella insurance? Here are some examples where it might come in handy Does Umbrella Insurance Cover Deductible umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. Umbrella insurance kicks in when you reach your “base” liability limits for a. how does umbrella insurance work? umbrella insurance (also known as excess liability insurance) is a type of coverage designed to cover potential gaps left by other. Does Umbrella Insurance Cover Deductible.

From www.savinjones.com

Do you have Umbrella Insurance? Savin Jones Insurance Agency Does Umbrella Insurance Cover Deductible does umbrella insurance qualify as a tax deduction? an umbrella policy protects you from lawsuits and large claims that your homeowners or auto insurance policies don’t cover. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. umbrella insurance (also known as excess liability insurance) is a type. Does Umbrella Insurance Cover Deductible.

From blog.cfmimo.com

Insurance That Educates Breaking Down How A Personal Umbrella Policy Works Does Umbrella Insurance Cover Deductible umbrella insurance (also known as excess liability insurance) is a type of coverage designed to cover potential gaps left by other insurance. an umbrella policy protects you from lawsuits and large claims that your homeowners or auto insurance policies don’t cover. umbrella insurance is a type of personal liability insurance that can be indispensable when you find. Does Umbrella Insurance Cover Deductible.

From www.insurancecentermo.com

Commercial vs. Personal Umbrella Insurance Does Umbrella Insurance Cover Deductible umbrella insurance is a type of personal liability insurance that can be indispensable when you find yourself liable for a claim larger than. Umbrella insurance kicks in when you reach your “base” liability limits for a. does umbrella insurance qualify as a tax deduction? an umbrella policy protects you from lawsuits and large claims that your homeowners. Does Umbrella Insurance Cover Deductible.

From smartestdollar.com

The Best Commercial Umbrella Insurance for 2023 A Complete Guide Does Umbrella Insurance Cover Deductible umbrella insurance (also known as excess liability insurance) is a type of coverage designed to cover potential gaps left by other insurance. how does umbrella insurance work? umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. Umbrella insurance kicks in when you reach your “base” liability limits for. Does Umbrella Insurance Cover Deductible.

From dxofwzkmh.blob.core.windows.net

What Does An Personal Umbrella Policy Cover at Gene Ryan blog Does Umbrella Insurance Cover Deductible umbrella insurance is a type of personal liability insurance that can be indispensable when you find yourself liable for a claim larger than. how does umbrella insurance work? Umbrella insurance kicks in when you reach your “base” liability limits for a. does umbrella insurance qualify as a tax deduction? an umbrella policy protects you from lawsuits. Does Umbrella Insurance Cover Deductible.

From www.slideserve.com

PPT Everything You Need to Know About Umbrella Insurance PowerPoint Presentation ID11874775 Does Umbrella Insurance Cover Deductible does umbrella insurance qualify as a tax deduction? Umbrella insurance kicks in when you reach your “base” liability limits for a. umbrella insurance (also known as excess liability insurance) is a type of coverage designed to cover potential gaps left by other insurance. an umbrella policy protects you from lawsuits and large claims that your homeowners or. Does Umbrella Insurance Cover Deductible.

From www.youtube.com

What is Umbrella Insurance? What does Umbrella Insurance Cover? YouTube Does Umbrella Insurance Cover Deductible does umbrella insurance qualify as a tax deduction? Umbrella insurance kicks in when you reach your “base” liability limits for a. umbrella insurance (also known as excess liability insurance) is a type of coverage designed to cover potential gaps left by other insurance. an umbrella policy protects you from lawsuits and large claims that your homeowners or. Does Umbrella Insurance Cover Deductible.

From referenceinsurance.blogspot.com

What Is Umbrella Insurance Cover Insurance Reference Does Umbrella Insurance Cover Deductible an umbrella policy protects you from lawsuits and large claims that your homeowners or auto insurance policies don’t cover. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. Umbrella insurance kicks in when you reach your “base” liability limits for a. umbrella insurance (also known as excess liability. Does Umbrella Insurance Cover Deductible.

From www.compass-insurance-agency.com

What is Umbrella Insurance and Why It's Important Compass Insurance Does Umbrella Insurance Cover Deductible umbrella insurance (also known as excess liability insurance) is a type of coverage designed to cover potential gaps left by other insurance. how does umbrella insurance work? does umbrella insurance qualify as a tax deduction? Umbrella insurance kicks in when you reach your “base” liability limits for a. umbrella insurance is a type of personal liability. Does Umbrella Insurance Cover Deductible.

From indianainsurancecoverage.blogspot.com

We Have You CoveredInsurance Insights The Types & Layers of Insurance Coverage Does Umbrella Insurance Cover Deductible does umbrella insurance qualify as a tax deduction? umbrella insurance (also known as excess liability insurance) is a type of coverage designed to cover potential gaps left by other insurance. umbrella insurance is a type of personal liability insurance that can be indispensable when you find yourself liable for a claim larger than. umbrella insurance —. Does Umbrella Insurance Cover Deductible.

From g2insuranceservices.com

Umbrella G2 Insurance Services Brookfield Insurance Does Umbrella Insurance Cover Deductible how does umbrella insurance work? does umbrella insurance qualify as a tax deduction? umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. an umbrella policy protects you from lawsuits and large claims that your homeowners or auto insurance policies don’t cover. Umbrella insurance kicks in when you. Does Umbrella Insurance Cover Deductible.

From www.strockinsurance.com

What Is Umbrella Insurance and What Does It Cover? Does Umbrella Insurance Cover Deductible umbrella insurance is a type of personal liability insurance that can be indispensable when you find yourself liable for a claim larger than. an umbrella policy protects you from lawsuits and large claims that your homeowners or auto insurance policies don’t cover. how does umbrella insurance work? umbrella insurance — sometimes called personal liability umbrella insurance. Does Umbrella Insurance Cover Deductible.

From www.annuityexpertadvice.com

What Is Umbrella Insurance & How Can It Help You? (2023) Does Umbrella Insurance Cover Deductible Umbrella insurance kicks in when you reach your “base” liability limits for a. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. how does umbrella insurance work? umbrella insurance (also known as excess liability insurance) is a type of coverage designed to cover potential gaps left by other. Does Umbrella Insurance Cover Deductible.