Sterling Colorado Sales Tax . City of sterling 3.0% logan county 1.0% platte valley rta. sales tax inquiry & online return pay. The city collects this for tangible retail sales. the 7% sales tax rate in sterling consists of 2.9% colorado state sales tax, 1% logan county sales tax, 3% sterling tax and 0.1%. If seasonal, please list exact months of your. This is the total of state, county, and city sales tax rates. sterling, co sales tax rate. The december 2020 total local sales tax rate. the sterling, colorado sales tax is 7.00%, consisting of 2.90% colorado state sales tax and 4.10% sterling local sales taxes.the. The current total local sales tax rate in sterling, co is 7.000%. the geographic information system (gis) now allows colorado taxpayers to look up the specific sales tax rate for an individual. To login and view your account, file a return, or renew your license, you will need to use your city. the minimum combined 2024 sales tax rate for sterling, colorado is 7.0%.

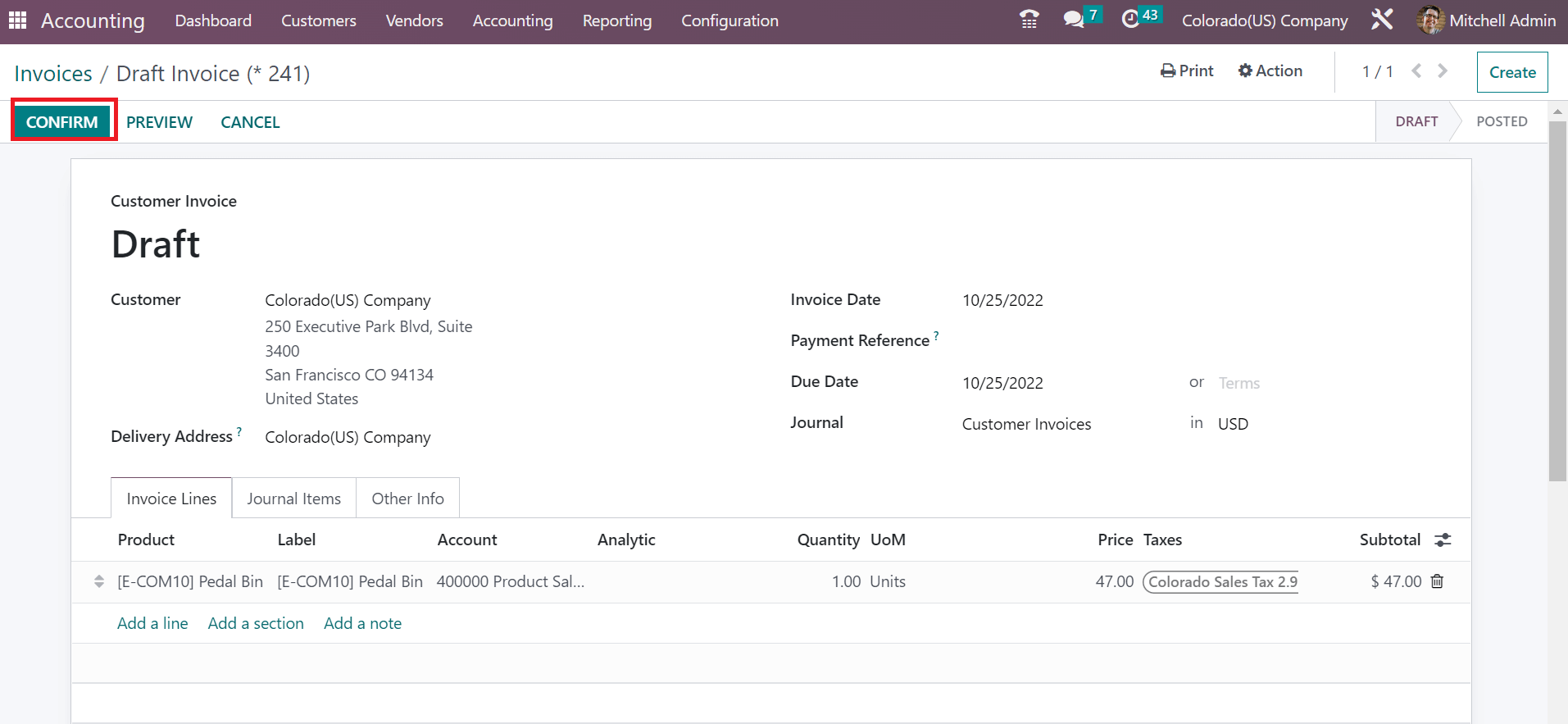

from www.cybrosys.com

To login and view your account, file a return, or renew your license, you will need to use your city. sterling, co sales tax rate. The city collects this for tangible retail sales. City of sterling 3.0% logan county 1.0% platte valley rta. the minimum combined 2024 sales tax rate for sterling, colorado is 7.0%. The current total local sales tax rate in sterling, co is 7.000%. The december 2020 total local sales tax rate. This is the total of state, county, and city sales tax rates. If seasonal, please list exact months of your. the 7% sales tax rate in sterling consists of 2.9% colorado state sales tax, 1% logan county sales tax, 3% sterling tax and 0.1%.

Sales Tax Configuration in Colorado(US) using Odoo 16 Accounting

Sterling Colorado Sales Tax sales tax inquiry & online return pay. The december 2020 total local sales tax rate. The current total local sales tax rate in sterling, co is 7.000%. This is the total of state, county, and city sales tax rates. the 7% sales tax rate in sterling consists of 2.9% colorado state sales tax, 1% logan county sales tax, 3% sterling tax and 0.1%. The city collects this for tangible retail sales. the minimum combined 2024 sales tax rate for sterling, colorado is 7.0%. To login and view your account, file a return, or renew your license, you will need to use your city. If seasonal, please list exact months of your. City of sterling 3.0% logan county 1.0% platte valley rta. the geographic information system (gis) now allows colorado taxpayers to look up the specific sales tax rate for an individual. sterling, co sales tax rate. sales tax inquiry & online return pay. the sterling, colorado sales tax is 7.00%, consisting of 2.90% colorado state sales tax and 4.10% sterling local sales taxes.the.

From www.gobankingrates.com

Sales Tax by State Here's How Much You're Really Paying GOBankingRates Sterling Colorado Sales Tax If seasonal, please list exact months of your. The current total local sales tax rate in sterling, co is 7.000%. the 7% sales tax rate in sterling consists of 2.9% colorado state sales tax, 1% logan county sales tax, 3% sterling tax and 0.1%. To login and view your account, file a return, or renew your license, you will. Sterling Colorado Sales Tax.

From www.templateroller.com

Form 0594 Fill Out, Sign Online and Download Printable PDF, Colorado Templateroller Sterling Colorado Sales Tax the geographic information system (gis) now allows colorado taxpayers to look up the specific sales tax rate for an individual. sterling, co sales tax rate. The city collects this for tangible retail sales. The december 2020 total local sales tax rate. sales tax inquiry & online return pay. If seasonal, please list exact months of your. This. Sterling Colorado Sales Tax.

From rasiusa.com

Do The Latest Colorado Sales Tax Changes Impact Your Restaurant? Sterling Colorado Sales Tax To login and view your account, file a return, or renew your license, you will need to use your city. The current total local sales tax rate in sterling, co is 7.000%. sales tax inquiry & online return pay. the sterling, colorado sales tax is 7.00%, consisting of 2.90% colorado state sales tax and 4.10% sterling local sales. Sterling Colorado Sales Tax.

From quaderno.io

Colorado Sales Tax rates, thresholds, and registration guide Sterling Colorado Sales Tax To login and view your account, file a return, or renew your license, you will need to use your city. the 7% sales tax rate in sterling consists of 2.9% colorado state sales tax, 1% logan county sales tax, 3% sterling tax and 0.1%. The city collects this for tangible retail sales. The current total local sales tax rate. Sterling Colorado Sales Tax.

From fallonqkarina.pages.dev

Colorado State Sales Tax Rate 2024 Valry Jacinthe Sterling Colorado Sales Tax sterling, co sales tax rate. If seasonal, please list exact months of your. The current total local sales tax rate in sterling, co is 7.000%. the minimum combined 2024 sales tax rate for sterling, colorado is 7.0%. the 7% sales tax rate in sterling consists of 2.9% colorado state sales tax, 1% logan county sales tax, 3%. Sterling Colorado Sales Tax.

From www.formsbank.com

Form Dr 1002 Colorado Sales/use Tax Rates printable pdf download Sterling Colorado Sales Tax The city collects this for tangible retail sales. the sterling, colorado sales tax is 7.00%, consisting of 2.90% colorado state sales tax and 4.10% sterling local sales taxes.the. the minimum combined 2024 sales tax rate for sterling, colorado is 7.0%. This is the total of state, county, and city sales tax rates. the geographic information system (gis). Sterling Colorado Sales Tax.

From taxfoundation.org

2021 Sales Tax Rates State & Local Sales Tax by State Tax Foundation Sterling Colorado Sales Tax the geographic information system (gis) now allows colorado taxpayers to look up the specific sales tax rate for an individual. The current total local sales tax rate in sterling, co is 7.000%. The city collects this for tangible retail sales. the sterling, colorado sales tax is 7.00%, consisting of 2.90% colorado state sales tax and 4.10% sterling local. Sterling Colorado Sales Tax.

From www.quaderno.io

Colorado Sales Tax, in a Nutshell Quaderno Sterling Colorado Sales Tax sales tax inquiry & online return pay. the minimum combined 2024 sales tax rate for sterling, colorado is 7.0%. The december 2020 total local sales tax rate. the 7% sales tax rate in sterling consists of 2.9% colorado state sales tax, 1% logan county sales tax, 3% sterling tax and 0.1%. the sterling, colorado sales tax. Sterling Colorado Sales Tax.

From www.templateroller.com

Form DR0024 Download Fillable PDF or Fill Online Standard Sales Tax Receipt for Vehicle Sales Sterling Colorado Sales Tax If seasonal, please list exact months of your. The december 2020 total local sales tax rate. The current total local sales tax rate in sterling, co is 7.000%. This is the total of state, county, and city sales tax rates. the 7% sales tax rate in sterling consists of 2.9% colorado state sales tax, 1% logan county sales tax,. Sterling Colorado Sales Tax.

From www.usacoinbook.com

1/5 cent Colorado Sales tax token NICE For Sale, Buy Now Online Item 695468 Sterling Colorado Sales Tax the minimum combined 2024 sales tax rate for sterling, colorado is 7.0%. the geographic information system (gis) now allows colorado taxpayers to look up the specific sales tax rate for an individual. To login and view your account, file a return, or renew your license, you will need to use your city. If seasonal, please list exact months. Sterling Colorado Sales Tax.

From www.templateroller.com

Form CR0100AP Fill Out, Sign Online and Download Fillable PDF, Colorado Templateroller Sterling Colorado Sales Tax The city collects this for tangible retail sales. If seasonal, please list exact months of your. This is the total of state, county, and city sales tax rates. The current total local sales tax rate in sterling, co is 7.000%. sales tax inquiry & online return pay. the sterling, colorado sales tax is 7.00%, consisting of 2.90% colorado. Sterling Colorado Sales Tax.

From www.templateroller.com

City of Sterling, Colorado Sales / Use Tax Return Form Fill Out, Sign Online and Download PDF Sterling Colorado Sales Tax This is the total of state, county, and city sales tax rates. If seasonal, please list exact months of your. City of sterling 3.0% logan county 1.0% platte valley rta. the 7% sales tax rate in sterling consists of 2.9% colorado state sales tax, 1% logan county sales tax, 3% sterling tax and 0.1%. The current total local sales. Sterling Colorado Sales Tax.

From www.formsbank.com

Amended Sales/use Tax Return City Of Sterling printable pdf download Sterling Colorado Sales Tax sales tax inquiry & online return pay. sterling, co sales tax rate. the geographic information system (gis) now allows colorado taxpayers to look up the specific sales tax rate for an individual. The city collects this for tangible retail sales. The december 2020 total local sales tax rate. the 7% sales tax rate in sterling consists. Sterling Colorado Sales Tax.

From salestaxdatalink.com

Sales Tax Gets Complex in Colorado Sales Tax DataLINK Sterling Colorado Sales Tax the minimum combined 2024 sales tax rate for sterling, colorado is 7.0%. If seasonal, please list exact months of your. The december 2020 total local sales tax rate. To login and view your account, file a return, or renew your license, you will need to use your city. City of sterling 3.0% logan county 1.0% platte valley rta. . Sterling Colorado Sales Tax.

From www.salestaxsolutions.us

Colorado Sales Tax Filing Colorado Sales And Use Tax Sterling Colorado Sales Tax sales tax inquiry & online return pay. sterling, co sales tax rate. To login and view your account, file a return, or renew your license, you will need to use your city. The december 2020 total local sales tax rate. The current total local sales tax rate in sterling, co is 7.000%. City of sterling 3.0% logan county. Sterling Colorado Sales Tax.

From www.bpicustomprinting.com

Colorado Standard Sales Tax Receipt Pad BPI Custom Printing Sterling Colorado Sales Tax the geographic information system (gis) now allows colorado taxpayers to look up the specific sales tax rate for an individual. the sterling, colorado sales tax is 7.00%, consisting of 2.90% colorado state sales tax and 4.10% sterling local sales taxes.the. The current total local sales tax rate in sterling, co is 7.000%. This is the total of state,. Sterling Colorado Sales Tax.

From www.signnow.com

Dr1002 20212024 Form Fill Out and Sign Printable PDF Template airSlate SignNow Sterling Colorado Sales Tax the geographic information system (gis) now allows colorado taxpayers to look up the specific sales tax rate for an individual. The december 2020 total local sales tax rate. This is the total of state, county, and city sales tax rates. sales tax inquiry & online return pay. To login and view your account, file a return, or renew. Sterling Colorado Sales Tax.

From statesalestaxtobitomo.blogspot.com

State Sales Tax Colorado State Sales Tax Rate Sterling Colorado Sales Tax To login and view your account, file a return, or renew your license, you will need to use your city. the geographic information system (gis) now allows colorado taxpayers to look up the specific sales tax rate for an individual. City of sterling 3.0% logan county 1.0% platte valley rta. sterling, co sales tax rate. If seasonal, please. Sterling Colorado Sales Tax.